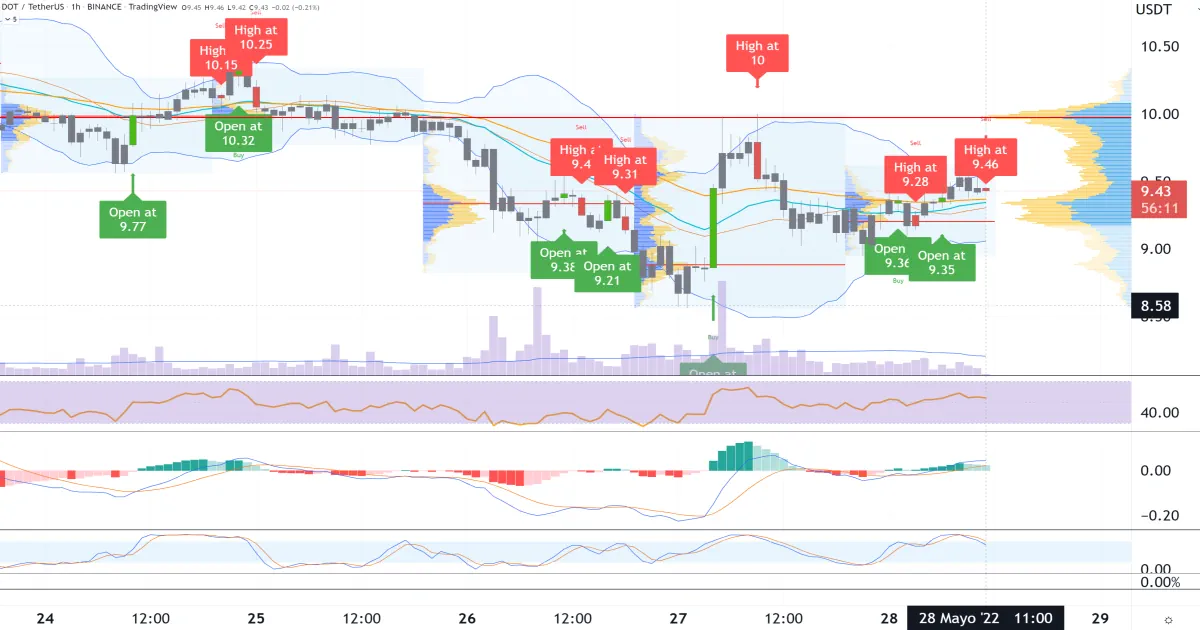

Polkadot Moving Down Polkadot (DOT) Long

Term Analysis May 28, 2022 –

The cost of Bearish Polkadot (DOT) is falling as the bears try to break the previous low of $7.18. In the previous cost action, the altcoin has been in a range shift between the $8 and $12 cost levels.

On the downside, if the bears break below the $8.00 support, the trading pressure will build. will resume. The altcoin will go back to the previous low of $7.18. However, if the $8 support holds and the altcoin rebounds, the cost of DOT will rise above the $12 resistance. Bullish encouragement will extend to the $16 high.

Technical Indicators: Major Resistance Levels: $48, $52, $56 Major Support Levels: $32, $28, $24 Polkadot (DOT) Indicator Analysis DOT cost is at degree 38 of the Relative Strength Index for time frame 14. Polkadot is in the downtrend sector as sellers come back to sink the currency. The altcoin is below the 50% range of the daily stochastic. The market has resumed bearish encouragement. The 21-day SMA line and the 50-day SMA line are sloping south, suggesting a downtrend.

What is the next address for Polkadot (DOT)? Polkadot is likely to pull back further as sellers try to break the previous low of $7.18. As much, the May 12 downtrend; a retraced candlestick human body tested the 78.6% Fibonacci retracement degree. The retracement indicates that the DOT cost will fall to the Fibonacci expansion of the 1.272 degree or the $4.90 degree

Note: SignalsBitcoin.com is not a financial advisor. Do your research before investing your funds in any financial asset or featured product or event. We are not responsible for your investment results

_corrige_a_la_baja_28_de_mayo_de_2022_2022_05_28_img1.webp)

_cotiza_entre_$1900_y_$2000_y_puede_recobrar_posiciones_2022_05_26_img1.webp)

_en_un_rango_bajista_2022_05_26_img1.webp)